On Friday, November 14th, the Turnaround & Restructuring Club successfully hosted its annual Turnaround Conference featuring esteemed panelists from the industry. The event kicked off with a fireside chat featuring Stephen Toy (Senior Managing Director and Co-Head, WL Ross & Co. LLC) and moderated by HBS Professor Kristin Mugford. Mr. Toy spoke in detail about his vast turnaround experiences and when asked about current trends stated, “Currently the market is doing pretty well, so there’s not as much restructuring needed. The industry is countercyclical.”

Next was the Turnaround and Advisory Management Panel featuring Robert Himmel (Co-President, Commercial & Industrial Division, Gordon Brothers Credit Partners), Patrick Lahaie (Partner, McKinsey & Company) John J. Monaghan (Partner – Holland & Knight), and Mark Weinsten (Senior Managing Director, FTI Consulting). This panel discussion, which was moderated by Howard Brownstein (President and CEO, Brownstein Corp.), provided several first-hand accounts of turnaround stories. One panelist noted, “CEOs report to CRO! (Chief Restructuring Officer)”

The Distressed Investing Panel featured another vibrant group of panelists, including Joel Biran (Managing Principal, DWIM; Former Managing Director, Versa Capital Management), David Levenson (Co-founder and Partner, Goldbridge Capital Partners; Former Investment Professional, BlueBay Asset Management), and Vikram Punwani (Managing Director, Bain Capital / Sankaty Advisors). Each panelist shared personal anecdotes about prior turnaround experiences, with some specifying why they currently view certain industries as more attractive than others.

This portion of the event wrapped up with a presentation by Peter Cuneo, Managing Principal of Cuneo & Company, LLC; Former CEO of Marvel Entertainment. Mr. Cuneo shared his views of what makes one successful in turnarounds and outlined some of the challenges a manager will face. He mentioned, “The hard part of the turnaround is not the strategy… but the people side of it.” He concluded with a few life and career lessons that have guided him throughout his highly successful career.

The evening was topped off by a cocktail hour during which attendees had the opportunity to chat with the panelists and presenters.

– Marquis McGuffin, Chief Marketing Officer, Turnaround & Restructuring Club

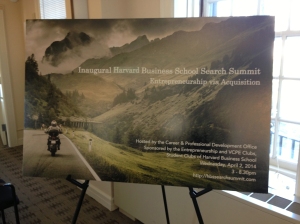

2nd, HBS Career & Professional Development, in conjunction with the Venture Capital & Private Equity and Entrepreneurship Clubs, hosted the inaugural

2nd, HBS Career & Professional Development, in conjunction with the Venture Capital & Private Equity and Entrepreneurship Clubs, hosted the inaugural